Flash Report: Critical Supply Chain Disruptions Q1 2025 US

A new flash report signals impending critical supply chain disruptions across key US sectors in Q1 2025, demanding immediate attention from businesses and policymakers to mitigate widespread economic impact.

A new alert has just been issued, highlighting that significant challenges are on the horizon. A Flash Report: Critical Supply Chain Disruptions Expected in Q1 2025 Across Key US Sectors indicates that businesses and consumers alike should brace for potential impacts. What exactly does this mean for the stability of our markets, and how will it affect everyday life?

Understanding the Looming Crisis in Q1 2025

The latest intelligence from industry analysts points to a period of heightened vulnerability for American supply chains as Q1 2025 approaches. This isn’t merely a continuation of past issues; new, complex factors are converging to create a unique set of challenges that could severely test the resilience of various sectors.

Experts are citing a confluence of geopolitical instability, evolving regulatory landscapes, and persistent labor shortages as primary drivers. These elements are not operating in isolation, but rather exacerbating each other, creating a ripple effect that could disrupt everything from raw material acquisition to final product delivery.

Geopolitical Tensions and Trade Routes

Rising geopolitical tensions globally are a significant contributor to the anticipated disruptions. Key trade routes, particularly those involving critical raw materials and components, are under increased pressure. This situation could lead to:

- Increased Shipping Costs: Higher insurance premiums and rerouting due to conflict zones.

- Extended Transit Times: Delays at ports and customs due to enhanced security checks or diversions.

- Reduced Availability of Goods: Supply shortages for specific components or finished products.

The intricate web of international trade means that even localized conflicts can have global repercussions, directly affecting the flow of goods into and within the United States. Businesses are advised to review their international sourcing strategies promptly.

Key Sectors Under Threat: Manufacturing and Technology

The flash report specifically identifies manufacturing and technology as two sectors particularly susceptible to the impending disruptions. These industries rely heavily on complex global supply chains for specialized components and raw materials, making them highly sensitive to any volatility.

In manufacturing, the just-in-time inventory models, while efficient, leave little room for error when disruptions occur. Any delay in component delivery can halt production lines, leading to significant financial losses and backlogs. For technology, the reliance on a few key global suppliers for advanced semiconductors and rare-earth minerals presents a single point of failure that could have cascading effects.

Impact on Manufacturing Output

Manufacturers across the US are already grappling with fluctuating demand and rising input costs. The anticipated Q1 2025 disruptions could further compress margins and potentially force production cuts. This scenario poses a direct threat to economic growth and employment within these critical industries.

- Automotive Industry: Expected delays in semiconductor and specialized part deliveries.

- Electronics Production: Shortages of microchips and circuit boards impacting consumer availability.

- Heavy Machinery: Delays in sourcing steel, alloys, and hydraulic components.

The ability to adapt quickly, perhaps by diversifying supplier bases or investing in domestic production capabilities, will be crucial for companies in these sectors to navigate the challenging period ahead.

Labor Shortages and Infrastructure Strain

Beyond international factors, domestic issues continue to exert pressure on supply chains. Persistent labor shortages, particularly in transportation and logistics, are expected to compound the problem in Q1 2025. Truck drivers, warehouse workers, and port operators remain in high demand, leading to operational inefficiencies and delays.

Simultaneously, the US’s aging infrastructure continues to be a bottleneck. Roads, bridges, and ports, while undergoing some modernization, are still struggling to keep pace with the volume of goods being transported. This creates chokepoints that can turn minor disruptions into major logistical nightmares.

The combination of insufficient workforce and strained physical infrastructure means that even if goods arrive at US ports, moving them efficiently to their final destinations could prove challenging. This internal friction adds another layer of complexity to the overall supply chain landscape.

Rising Costs and Inflationary Pressures

One of the most immediate and tangible effects of the predicted supply chain disruptions in Q1 2025 will be an increase in operational costs for businesses, which will likely translate into higher prices for consumers. Transportation, warehousing, and inventory management expenses are all projected to rise.

The scarcity of certain goods due to disrupted supply lines will also contribute to inflationary pressures. When demand outstrips supply, prices naturally increase. This could impact everything from essential consumer goods to industrial components, potentially affecting household budgets and corporate profitability.

Consumer Impact and Market Volatility

Consumers should prepare for potential price hikes and reduced availability of some products. Retailers, facing higher sourcing and logistics costs, will likely pass some of these expenses onto their customers. This could lead to:

- Higher Retail Prices: Across various consumer goods categories.

- Limited Product Choices: Especially for imported or component-heavy items.

- Longer Delivery Times: For online orders and specialized products.

Market analysts are closely monitoring these trends, wary of the potential for broader economic instability if these cost increases become sustained. The Federal Reserve and other economic bodies will undoubtedly be watching these developments closely as they formulate monetary policy.

Mitigation Strategies and Preparedness

In response to the impending challenges, businesses are urged to review and bolster their supply chain resilience strategies. Proactive measures taken now can significantly reduce the impact of the disruptions in Q1 2025. Diversification and technological adoption are emerging as key themes for preparedness.

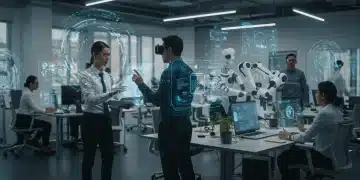

Many companies are exploring nearshoring or reshoring options to reduce reliance on distant and potentially volatile supply sources. While this requires significant investment, the long-term benefits of increased control and reduced risk are becoming increasingly attractive. Furthermore, investing in advanced analytics and AI for predictive modeling can help identify potential disruptions before they fully materialize.

Building Resilient Supply Chains

Effective mitigation strategies involve a multi-faceted approach. Companies are looking at several key areas to build more robust supply chains:

- Supplier Diversification: Reducing dependence on a single supplier or region.

- Inventory Optimization: Balancing just-in-time efficiency with strategic buffer stocks.

- Digital Transformation: Implementing technologies for real-time tracking and visibility.

- Workforce Training: Addressing labor shortages through upskilling and retention programs.

Collaboration across the supply chain, from raw material providers to final distributors, will also be essential. Information sharing and coordinated efforts can help identify vulnerabilities and implement solutions more effectively.

Government and Industry Responses

The US government and various industry bodies are actively monitoring the situation and exploring potential responses to the anticipated Q1 2025 supply chain disruptions. Discussions are underway regarding infrastructure investments, trade policies, and incentives for domestic production.

Policymakers are keenly aware of the economic and national security implications of vulnerable supply chains. There is a growing consensus that a concerted effort is needed to enhance resilience, involving both public and private sector collaboration. This includes fostering innovation in logistics and manufacturing technologies.

Industry associations are also playing a crucial role, facilitating information exchange and advocating for policies that support supply chain stability. They are working to provide their members with timely updates and best practices to navigate the complex landscape ahead. The goal is to minimize economic fallout and ensure the continued flow of essential goods.

| Key Point | Brief Description |

|---|---|

| Global Instability | Geopolitical tensions and conflicts are causing increased shipping costs and extended transit times for international trade routes. |

| Sector Vulnerabilities | Manufacturing and technology sectors are highly susceptible due to reliance on complex global supply chains for critical components. |

| Domestic Challenges | Persistent labor shortages in logistics and aging infrastructure contribute to internal bottlenecks and delays. |

| Mitigation Strategies | Businesses are urged to diversify suppliers, optimize inventory, and adopt digital tools to enhance supply chain resilience. |

Frequently Asked Questions About Q1 2025 Supply Chain Disruptions

The disruptions are primarily driven by escalating geopolitical tensions affecting trade routes, persistent labor shortages in critical logistics roles, and the ongoing strain on aging US infrastructure. These factors combine to create a challenging environment for global and domestic supply lines.

The manufacturing and technology sectors are identified as most vulnerable. Their heavy reliance on complex global supply chains for specialized components, such as semiconductors and raw materials, makes them highly susceptible to delays and shortages.

Consumers can expect potential price increases for various goods due to higher operational and transportation costs for businesses. Additionally, reduced availability of certain products and longer delivery times for online orders are anticipated.

Businesses should focus on diversifying their supplier base, optimizing inventory levels with strategic buffer stocks, and investing in digital transformation for better visibility and real-time tracking. Exploring nearshoring options is also a recommended strategy.

The US government is actively monitoring the situation, contemplating infrastructure investments, reviewing trade policies, and considering incentives for domestic production. Collaboration between public and private sectors is seen as crucial to enhancing overall supply chain resilience.

Looking Ahead: Navigating the Complexities

The impending Flash Report: Critical Supply Chain Disruptions Expected in Q1 2025 Across Key US Sectors underscores the dynamic and interconnected nature of global commerce. While the challenges are significant, the proactive identification of these risks provides a crucial window for preparation. Businesses that adapt quickly, embrace technological solutions, and foster robust partnerships will be better positioned to weather the storm. Policymakers will continue to assess the evolving landscape, with an eye towards long-term resilience and stability for the US economy. The coming months will be critical in shaping the response to these complex global and domestic pressures.