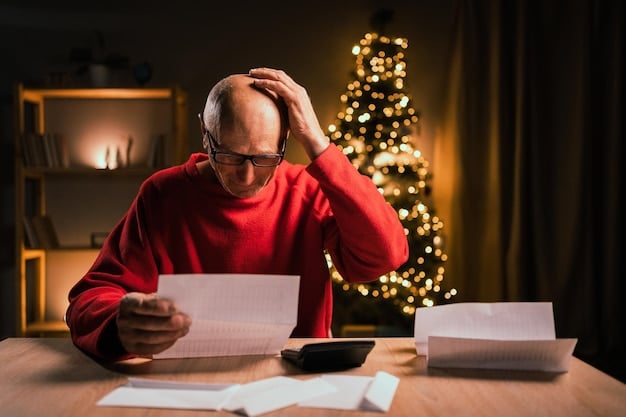

Financial Stress in America: Why 65% Struggle Monthly

A staggering statistic reveals that over 65% of Americans face financial stress at least once a month, impacting their mental health, relationships, and overall well-being, necessitating a deeper understanding of the root causes and potential solutions.

It’s a common misconception that financial stability is the norm. However, a recent incredible statistic: over 65% of Americans experience financial stress at least once a month, revealing a widespread struggle that affects individuals from all walks of life. This article delves into the reasons behind this pervasive issue and explores potential avenues for relief.

Understanding the Widespread Impact of Financial Stress

Financial stress is more than just worrying about money; it’s a persistent anxiety that can permeate every aspect of life. This section explores the far-reaching consequences of this stress, affecting not only individual well-being but also relationships and professional performance.

Mental Health Toll

The constant worry about finances can lead to various mental health issues. Anxiety and depression are common companions of financial strain, making it difficult to cope with daily life.

Relationship Strain

Money is a frequent topic of disagreement in relationships. Financial stress can exacerbate these tensions, leading to conflict and even separation.

- Decreased communication and intimacy.

- Increased arguments and resentment.

- Difficulty planning for the future together.

These factors can significantly damage the foundation of any relationship.

Impact on Work Performance

Financial worries can also affect an individual’s ability to focus and perform at work. This can lead to decreased productivity, errors, and even job loss, further compounding the financial stress.

The cycle of stress, poor performance, and further financial instability can be difficult to break.

In conclusion, financial stress is a pervasive issue with a wide range of negative consequences, affecting mental health, relationships, and work performance. Recognizing the depth of this impact is the first step towards addressing the problem and finding effective solutions.

Delving into the Root Causes of American Financial Stress

To understand why such a large portion of the population experiences financial stress, it’s crucial to examine the underlying factors contributing to this phenomenon. This section explores several key causes, ranging from stagnant wages to unexpected expenses.

Stagnant Wages and Rising Costs

For many Americans, wages haven’t kept pace with the rising cost of living. This disparity makes it difficult to cover basic expenses and save for the future.

Inflation erodes purchasing power, making it harder to afford necessities.

Debt Burden: Student Loans, Credit Cards, and More

Debt plays a significant role in financial stress. Student loans, credit card debt, and other forms of borrowing can create a heavy burden that’s difficult to manage.

Lack of Financial Literacy

Many individuals lack the knowledge and skills needed to manage their finances effectively. This can lead to poor financial decisions and increased stress.

- Difficulty budgeting and tracking expenses.

- Lack of understanding of investment options.

- Inability to negotiate better financial terms.

Financial education is crucial for empowering individuals to take control of their financial lives.

Unexpected Expenses

Life is full of surprises, and unexpected expenses can derail even the most carefully planned budget. Healthcare costs, car repairs, and home maintenance can all contribute to financial stress.

Emergency funds are essential for mitigating the impact of unforeseen expenses.

In conclusion, the roots of American financial stress are multifaceted, encompassing stagnant wages, rising living costs, debt burdens, lack of financial literacy, and the inevitability of unexpected expenses. Addressing these underlying issues is essential for creating a more financially secure society.

The Role of Economic Instability and Job Security

Economic uncertainty and job insecurity significantly contribute to financial stress. This section examines how these factors impact individuals’ financial well-being and explores strategies for navigating these challenging environments.

Fluctuations in the Job Market

Job losses and periods of unemployment can quickly deplete savings and create significant financial hardship. The fear of losing a job can also contribute to constant stress.

The Gig Economy and Unstable Income

The rise of the gig economy has created opportunities for flexible work, but it often comes with unstable income and a lack of benefits. This volatility can make it difficult to plan for the future and manage finances effectively.

Lack of Employer-Sponsored Benefits

Many employers no longer offer comprehensive benefits packages, leaving employees responsible for covering healthcare costs, retirement savings, and other essential needs. This shift places a greater financial burden on individuals and families.

- Rising healthcare premiums and deductibles.

- Inadequate retirement savings plans.

- Limited access to paid time off and family leave.

These factors contribute to increased financial anxiety and vulnerability.

The Impact of Inflation on Savings

Even individuals with savings can feel the strain of economic instability. Inflation erodes the value of savings over time, making it harder to achieve long-term financial goals.

Diversifying investments and seeking professional financial advice can help mitigate the impact of inflation.

In conclusion, economic instability and job insecurity are major contributors to financial stress in America. Addressing these issues requires a combination of policy changes, employer responsibility, and individual financial planning.

Strategies for Managing and Reducing Financial Stress

While systemic issues contribute to financial stress, there are also practical steps individuals can take to manage and reduce its impact. This section outlines several strategies for improving financial well-being and alleviating stress.

Creating a Budget and Tracking Expenses

The first step towards financial control is creating a budget and tracking expenses. This allows individuals to understand where their money is going and identify areas for potential savings.

Prioritizing Debt Reduction

Developing a plan to pay down debt is crucial for reducing financial stress. Prioritize high-interest debt and explore options for debt consolidation or refinancing.

Building an Emergency Fund

An emergency fund can provide a safety net for unexpected expenses, reducing the need to rely on debt. Aim to save at least three to six months’ worth of living expenses.

- Start small and gradually increase savings.

- Automate savings to make it easier to stay on track.

- Keep the emergency fund separate from other savings accounts.

This financial cushion can provide peace of mind and prevent financial crises.

Seeking Professional Financial Advice

A financial advisor can provide personalized guidance and support, helping individuals develop a financial plan that aligns with their goals and risk tolerance.

Investing in professional advice can pay off in the long run.

In conclusion, managing and reducing financial stress requires a proactive approach that includes budgeting, debt reduction, building an emergency fund, and seeking professional advice. By taking these steps, individuals can regain control of their finances and improve their overall well-being.

The Importance of Financial Literacy and Education

Financial literacy is a critical skill that empowers individuals to make informed decisions about their money. This section explores the role of financial education in reducing stress and improving financial outcomes.

Understanding Basic Financial Concepts

Many individuals lack a basic understanding of financial concepts such as budgeting, saving, investing, and debt management. Financial literacy education can fill these gaps and provide a foundation for sound financial decision-making.

Accessing Financial Education Resources

There are numerous resources available to help individuals improve their financial literacy. These include online courses, workshops, and community-based programs.

Incorporating Financial Education into Schools

Integrating financial education into school curricula can help young people develop good financial habits early in life. This can prevent them from making costly mistakes later on.

- Teaching budgeting and saving skills.

- Explaining the importance of credit and debt management.

- Introducing investment concepts and retirement planning.

Early financial education can have a lasting impact on financial well-being.

The Role of Employers in Financial Wellness

Employers can also play a role in promoting financial literacy and wellness among their employees. Offering financial education programs and resources can help employees manage their finances more effectively and reduce stress.

A financially healthy workforce is a more productive workforce.

In conclusion, financial literacy and education are essential for empowering individuals to take control of their finances and reduce stress. By providing access to education and resources, we can create a more financially resilient society.

Policy Changes and Systemic Solutions to Alleviate Financial Burden

While individual efforts are important, addressing the pervasive issue of financial stress also requires policy changes and systemic solutions. This section explores potential policy measures that could alleviate the financial burden on Americans.

Raising the Minimum Wage

Increasing the minimum wage can help ensure that low-wage workers earn a living wage that allows them to cover basic expenses and save for the future.

Expanding Access to Affordable Healthcare

Healthcare costs are a major source of financial stress for many Americans. Expanding access to affordable healthcare can reduce this burden and improve overall financial security.

Addressing Student Loan Debt

Student loan debt is a significant obstacle to financial well-being for millions of Americans. Policy changes such as debt forgiveness or income-based repayment plans can provide relief.

- Lowering interest rates on student loans.

- Simplifying the repayment process.

- Providing loan forgiveness for public service workers.

These measures can help ease the student loan burden and allow graduates to pursue their financial goals.

Strengthening Social Safety Nets

Strengthening social safety nets such as unemployment insurance and food assistance programs can provide a cushion for individuals who experience job loss or other financial hardship.

A robust social safety net can help prevent individuals from falling into poverty.

In conclusion, alleviating the financial burden on Americans requires a multi-faceted approach that includes policy changes, systemic solutions, and individual efforts. By working together, we can create a more financially secure and equitable society.

| Key Point | Brief Description |

|---|---|

| 😟 High Stress Statistic | Over 65% of Americans feel financially stressed monthly. |

| 💸 Stagnant Wages | Wages haven’t kept pace with the rising cost of living. |

| 📚 Improve Literacy | Boost financial literacy to make informed decisions. |

| 🛡️ Build Savings | Create an emergency fund for unexpected life events. |

Frequently Asked Questions (FAQ)

▼

Financial stress involves worry and anxiety related to one’s monetary situation, often stemming from lack of funds, debt, or financial instability.

▼

Prolonged stress can lead to mental health issues like depression and anxiety, plus physical ailments such as headaches, high blood pressure, and digestive problems.

▼

Start with creating a budget to track income and expenses, identify areas to save, and set financial goals for the future.

▼

Many resources can enhance financial literacy, including online courses, workshops offered by community centers, and consultations with financial advisors.

▼

Policy changes addressing income inequality, healthcare costs, and student debt can significantly ease financial strain for many Americans, creating better opportunities.

Conclusion

The incredible statistic that over 65% of Americans experience financial stress monthly highlights a significant societal challenge. Addressing this requires a comprehensive approach that includes individual responsibility, increased financial literacy, and systemic policy changes to create a more financially secure future for all.