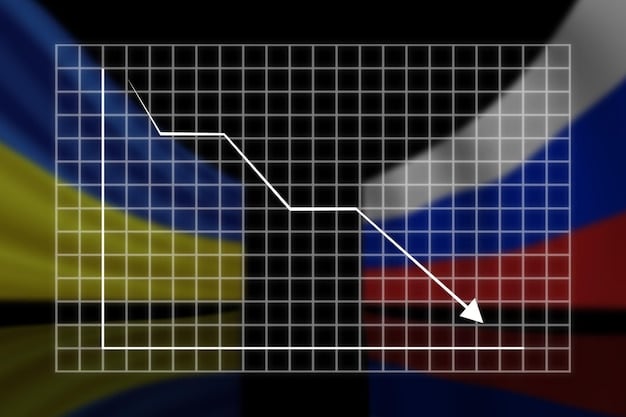

Alert: Business Confidence Index Plummets to Two-Year Low

The Business Confidence Index has hit its lowest point in two years, signaling potential economic headwinds and raising concerns among businesses about future growth and stability.

The latest Business Confidence Index (BCI) reveals a concerning trend: a sharp decline to its lowest level in two years. This downturn sparks critical questions about the health of the economy and the strategies businesses are adopting to navigate this challenging environment.

Understanding the Business Confidence Index (BCI)

The Business Confidence Index (BCI) serves as a vital barometer of economic sentiment, reflecting the optimism or pessimism of business leaders regarding the future. By understanding its components and historical trends, one can gain valuable insights into potential economic shifts.

What the BCI Measures

The BCI is a composite index that incorporates several key economic indicators and surveys of business expectations. These factors typically include:

- Current and expected economic conditions

- Sales forecasts

- Employment outlook

- Investment plans

Historical Significance

Historically, significant drops in the BCI have often foreshadowed economic slowdowns or recessions. Analyzing past BCI trends in relation to actual economic performance provides a framework for interpreting current declines.

Monitoring the BCI is crucial for investors, policymakers, and business owners. It offers a forward-looking perspective, enabling proactive strategies to mitigate risks and capitalize on opportunities. Understanding the cyclical nature of the BCI can help stakeholders prepare for potential market volatility and adjust their plans accordingly.

In conclusion, the BCI is a powerful tool for gauging the economic climate. Its recent decline warrants close attention and careful analysis to understand the potential implications for businesses and the broader economy.

The Current Downturn: Key Factors

Several factors contribute to the recent decline in the Business Confidence Index. Unpacking these elements is essential to understand the full scope of the current economic challenges.

Inflationary Pressures

Persistent inflation erodes purchasing power and increases operational costs for businesses. This has led to reduced consumer spending and tightened profit margins.

Supply Chain Disruptions

Ongoing disruptions in global supply chains continue to hamper production and increase lead times, affecting businesses across various sectors. These disruptions create uncertainty and drive up costs.

Geopolitical Instability

Global events and geopolitical tensions create uncertainty in the market, impacting investment decisions and trade relations.

- Increased risk aversion among investors

- Shifts in trade policies

- Volatile energy markets

Interest Rate Hikes

Central banks’ decisions to raise interest rates to combat inflation impact borrowing costs for businesses and consumers. Higher interest rates can slow down economic activity and reduce investment.

Together, these factors create a complex and challenging environment for businesses. The convergence of inflationary pressures, supply chain disruptions, geopolitical instability, and interest rate hikes contributes to the decline in business confidence.

Sector-Specific Impacts

The Business Confidence Index decline does not affect all sectors equally. Understanding the specific impacts on various industries provides a more nuanced view of the economic landscape.

Technology Sector

The technology sector, once a beacon of growth, faces slowing demand and increased scrutiny. Rising interest rates and inflation are prompting companies to re-evaluate their investments.

Manufacturing Sector

The manufacturing sector is grappling with supply chain bottlenecks and rising input costs. Tariffs and trade restrictions further complicate the situation, squeezing profit margins.

Retail Sector

The retail sector is directly affected by reduced consumer spending due to inflation and economic uncertainty. Online retailers also face challenges related to shipping costs and logistics.

- Decreased foot traffic in physical stores

- Lower online conversion rates

- Increased inventory holding costs

Energy Sector

While high energy prices can benefit some companies, volatility and geopolitical factors add complexity. Uncertainty about future energy demand and regulatory changes impact investment decisions.

The differential impact across sectors underscores the need for targeted strategies. Businesses need to understand the unique challenges and opportunities in their respective industries to navigate the economic downturn effectively.

Strategies for Businesses to Navigate the Downturn

Despite the bleak outlook, businesses can adopt strategic measures to weather the storm. Proactive planning and adaptability are key to surviving and even thriving in a challenging economic environment.

Cost Management

Implementing rigorous cost-cutting measures is essential to maintain profitability. This includes streamlining operations, renegotiating contracts, and reducing discretionary spending.

Innovation and Diversification

Investing in innovation and diversifying product lines can help businesses tap into new markets and reduce reliance on struggling sectors. Companies can explore new technologies and customer segments to drive growth.

Strengthening Customer Relationships

Focusing on customer retention and enhancing customer experience can provide a stable revenue base. Loyalty programs, personalized service, and proactive communication can strengthen customer relationships.

- Improving customer service channels

- Offering personalized promotions

- Soliciting and acting on customer feedback

Financial Planning and Risk Management

Developing robust financial plans and implementing effective risk management strategies can protect businesses from unforeseen shocks. This includes stress-testing balance sheets and hedging against currency and commodity risks.

By embracing these strategies, businesses can navigate the downturn with resilience and emerge stronger. Adaptive planning, cost management, and a focus on customer relationships are critical for long-term success.

Expert Opinions and Economic Forecasts

Gaining insights from economists and industry experts can help businesses make informed decisions. Understanding various perspectives on the future economic outlook provides a more comprehensive view.

Economist Perspectives

Leading economists offer varying predictions about the duration and severity of the downturn. Some anticipate a short-lived correction, while others foresee a longer period of stagnation.

Analyst Recommendations

Financial analysts provide recommendations on investment strategies and sector allocations. These recommendations can help businesses make informed decisions about capital deployment.

- Investing in defensive stocks

- Diversifying portfolios

- Focusing on value-oriented assets

Future Outlooks

Various forecasting models provide insights into potential economic trajectories. These models range from optimistic to pessimistic, depending on the underlying assumptions.

Staying informed about expert opinions and economic forecasts is crucial for strategic planning. By considering a range of perspectives, businesses can develop more resilient and adaptive strategies.

Policy Implications and Government Response

Government policies play a significant role in shaping the economic landscape. Understanding potential policy responses to the BCI downturn is crucial for businesses to anticipate and adapt.

Fiscal Measures

Governments may implement fiscal stimulus measures to boost economic activity. These measures could include tax cuts, infrastructure spending, and financial aid to businesses.

Monetary Policies

Central banks may adjust monetary policies to influence interest rates and money supply. Lowering interest rates or implementing quantitative easing can stimulate borrowing and investment.

Regulatory Changes

Governments may introduce regulatory changes to support specific sectors or address systemic risks. These changes could include deregulation, trade agreements, and consumer protection measures.

Anticipating policy changes allows businesses to adjust their strategies proactively. By understanding the potential impacts of government interventions, companies can better navigate the economic downturn and position themselves for future growth.

| Key Point | Brief Description |

|---|---|

| 📉 BCI Decline | Business Confidence Index hits a two-year low, signaling potential economic challenges. |

| 💰 Inflation | Persistent inflation erodes purchasing power and strains business profitability. |

| ⛓️ Supply Chains | Ongoing supply chain disruptions affect production and increase costs. |

| 🌐 Geopolitics | Geopolitical instability creates market uncertainty and affects investment decisions. |

Frequently Asked Questions (FAQ)

▼

The BCI is an economic indicator that measures the degree of optimism or pessimism that businesses feel about the economy. It reflects expectations for future business activity.

▼

The BCI provides a forward-looking perspective on the economy, helping businesses, investors, and policymakers anticipate potential economic shifts and adjust their strategies accordingly.

▼

Factors include inflation, interest rates, supply chain disruptions, geopolitical events, and government policies, all of which impact business operations and economic outlook.

▼

Businesses can focus on cost management, innovation, strengthening customer relationships, and robust financial planning to mitigate risks and capitalize on new opportunities.

▼

Government policies, such as fiscal measures, monetary policies, and regulatory changes, can significantly influence the BCI by either stimulating or dampening economic activity.

Conclusion

The recent decline in the Business Confidence Index to a two-year low signals potential headwinds for businesses. By understanding the underlying factors and adopting proactive strategies, companies can navigate these challenges and position themselves for future success, even in a volatile economic climate.