New FAFSA 2025-2026: Your Guide to Changes & Aid

The updated FAFSA for 2025-2026 streamlines the federal student aid process for US families, integrating new methodologies and expanded eligibility criteria to enhance access to higher education funding.

Understanding the New FAFSA: A Step-by-Step Guide for US Families for the 2025-2026 Cycle. is now more crucial than ever as significant changes reshape how students apply for federal financial aid. These reforms aim to simplify the process and expand aid eligibility, directly impacting college affordability for many American households.

Navigating the FAFSA Simplification Act: What’s New?

The FAFSA Simplification Act represents the most substantial overhaul of the federal student aid system in decades. For the 2025-2026 award year, families will encounter a redesigned application, new terminology, and a revised formula for determining financial need. These changes are designed to make the application process less burdensome and more equitable for a wider range of students seeking higher education.

One of the primary goals of the simplification is to reduce barriers to accessing financial aid. The previous FAFSA was often criticized for its complexity, leading many eligible students to forgo applying. The new system seeks to address these issues by streamlining questions and integrating data directly from IRS tax returns, a move intended to save applicants time and minimize errors.

Key Changes for the 2025-2026 FAFSA Cycle

- Streamlined Application: The number of questions on the FAFSA form has been significantly reduced, making it shorter and easier to complete. This aims to decrease the time families spend on the application.

- New Terminology: The Expected Family Contribution (EFC) has been replaced with the Student Aid Index (SAI). The SAI is a new eligibility index used to determine federal student aid, offering a more nuanced assessment of a family’s financial situation.

- Direct Data Exchange with IRS: A mandatory direct data exchange with the IRS will automatically transfer tax information, simplifying data entry and reducing the need for manual input, which was a common source of errors.

- Expanded Pell Grant Eligibility: More students will qualify for Federal Pell Grants, and the maximum Pell Grant award will be linked to inflation, providing greater stability and access to aid for low-income students.

These modifications collectively aim to improve the user experience and ensure that financial aid is distributed more effectively and fairly. Understanding these fundamental shifts is the first step for any family preparing to apply for federal student aid for the upcoming academic year.

Understanding the Student Aid Index (SAI)

The introduction of the Student Aid Index (SAI) is a cornerstone of the new FAFSA. This new index replaces the long-standing Expected Family Contribution (EFC) and represents a significant shift in how a student’s financial need is calculated. Unlike the EFC, the SAI can be a negative number, ranging from -1500 to 999,999, indicating a greater level of financial need. This change is particularly beneficial for students from low-income backgrounds, potentially opening doors to more aid.

The SAI calculation considers several factors, including income, assets, and family size, but with a revised methodology. For instance, the new formula places a greater emphasis on parent income and less on the number of children in college. This adjustment could impact families with multiple college students, a point of concern for some advocacy groups. The aim is to create a more accurate and equitable measure of a family’s ability to contribute to college costs.

How SAI Differs from EFC

- Negative SAI Possible: The SAI can go below zero, indicating a student has significant financial need and may be eligible for maximum federal and institutional aid.

- Impact of Family Size: The new formula explicitly removes the consideration of the number of family members in college, which was a factor in the EFC. This means families with multiple children in college may see a higher SAI than they would have with the EFC.

- Asset Protection Allowance: The asset protection allowance has been increased, shielding more of a family’s savings from the aid calculation. This change benefits families with modest savings, preventing those funds from disproportionately reducing their aid eligibility.

Families should familiarize themselves with the SAI concept and how it might affect their eligibility for federal student aid. Resources are available from the Department of Education and financial aid offices to help demystify these calculations and provide personalized insights. The goal is to ensure that the process of determining financial need is transparent and understandable for all applicants.

Step-by-Step Application Process for 2025-2026

Applying for federal student aid for the 2025-2026 academic year involves a series of crucial steps, each designed to ensure a smooth and accurate submission. The redesigned FAFSA aims to simplify this journey, but careful attention to detail remains paramount. Starting early and gathering all necessary documentation can significantly reduce stress and potential delays in receiving aid. The process begins with creating an FSA ID and then proceeds to the actual application.

The new FAFSA application will be available later than usual for the 2024-2025 cycle, so it’s important to monitor official announcements from the Department of Education for the exact opening date for the 2025-2026 cycle. Once available, applicants will find a more intuitive online experience, with fewer questions and clearer guidance. Both students and contributors (parents or guardians) will need to participate in the application process, providing their respective information.

Essential Steps for FAFSA Submission

- Create an FSA ID: Both the student and one parent (if applicable) must create an FSA ID. This serves as a legal signature and provides access to federal student aid websites. It’s crucial to create this well in advance of the application opening.

- Gather Required Documents: Collect necessary financial documents, including federal tax returns, W-2s, and records of any untaxed income. While the direct data exchange will pull most tax information, having these documents on hand can help verify details.

- Complete the FAFSA Online: Access the official FAFSA website and complete the application. The streamlined form will guide you through the process, but be sure to answer all questions accurately and completely.

- Review and Submit: Carefully review all information before submitting the FAFSA. Any errors could delay the processing of your application. Once submitted, save a confirmation for your records.

Following these steps meticulously will help ensure your application for the new FAFSA 2025-2026 is processed efficiently. Timely submission is critical, as some aid is awarded on a first-come, first-served basis, so meeting deadlines is key to maximizing your financial aid opportunities.

Eligibility and Aid Qualification Under New Rules

The revised FAFSA for 2025-2026 introduces changes to eligibility criteria, potentially expanding access to federal student aid for a broader demographic of US families. Understanding these new rules is essential for students to determine their qualification for various aid programs, including Pell Grants, federal loans, and work-study opportunities. The intent behind these modifications is to create a more inclusive system, ensuring that financial barriers do not unduly prevent deserving students from pursuing higher education.

A significant change relates to the automatic maximum Pell Grant eligibility. Under the new system, students whose Student Aid Index (SAI) is negative or falls within certain income thresholds relative to the federal poverty line may automatically qualify for the maximum Pell Grant. This is a substantial benefit for low-income students, providing a clear pathway to significant grant funding that does not need to be repaid. Additionally, the new FAFSA removes the prior requirement for male students to register for Selective Service to be eligible for federal aid, further broadening access.

Factors Affecting Aid Eligibility

- Student Aid Index (SAI): This is the primary determinant of financial need. A lower SAI indicates greater need and generally leads to more aid.

- Cost of Attendance (COA): Each institution’s COA, which includes tuition, fees, room, board, books, and other expenses, is subtracted from the SAI to determine a student’s financial need.

- Pell Grant Eligibility Thresholds: Specific income thresholds relative to the federal poverty line will now directly determine eligibility for the maximum Pell Grant, simplifying and expanding access.

- Family Size and Income: While the number of family members in college is no longer a factor, overall family size and adjusted gross income remain crucial in the SAI calculation.

These updated rules are designed to simplify the qualification process and make federal aid more accessible and predictable. Families should review their individual circumstances in light of these changes to accurately assess their potential aid eligibility for the new FAFSA 2025-2026 cycle.

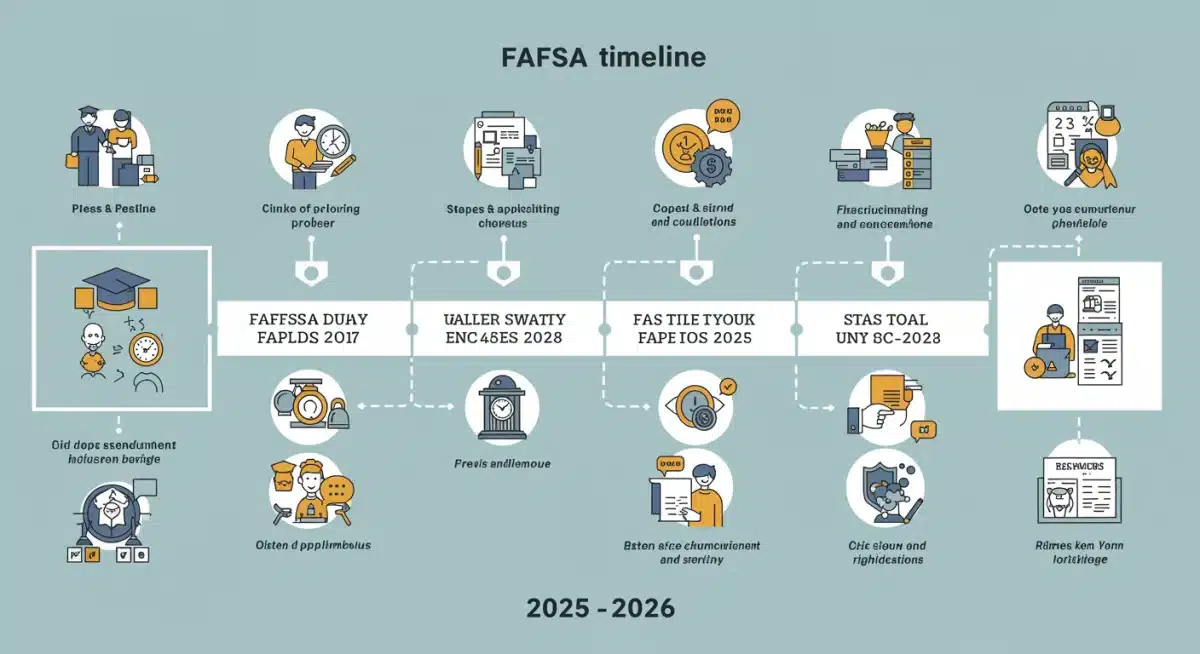

Deadlines and Important Dates for 2025-2026

Meeting deadlines is a critical component of securing financial aid through the FAFSA process. While the federal deadline for submitting the FAFSA is typically in June of the award year, states and individual colleges often have much earlier priority deadlines. For the 2025-2026 cycle, it is imperative for US families to be aware of all relevant dates to maximize their chances of receiving aid. Missing a deadline, especially a state or institutional one, can significantly impact the amount of financial assistance a student receives.

The exact opening date for the 2025-2026 FAFSA application has not yet been officially announced but is expected to be in late 2024. Due to the significant changes implemented with the FAFSA Simplification Act, the opening of the 2024-2025 FAFSA was delayed, and similar adjustments might occur for subsequent cycles. Families should regularly check the Federal Student Aid website and their prospective colleges’ financial aid pages for the most up-to-date information regarding application availability and specific deadlines.

Key Deadlines to Monitor

- FAFSA Availability: Expected late 2024 for the 2025-2026 academic year. Mark your calendars and prepare to apply as soon as it opens.

- State Deadlines: Each state sets its own FAFSA deadline, some as early as February or March. Check your state’s higher education agency website for specific dates.

- College Deadlines: Individual colleges often have their own priority deadlines for financial aid, which can be in early spring. These deadlines are crucial for institutional aid consideration.

- Federal Deadline: The final federal deadline for the 2025-2026 FAFSA is typically June 30, 2026. However, it is strongly advised to complete the application much earlier.

Proactive planning and diligent monitoring of these dates are crucial for families navigating the new FAFSA 2025-2026. Early submission allows for ample time to correct any errors and ensures consideration for all available aid programs, some of which have limited funding.

Common Pitfalls and How to Avoid Them

Despite the FAFSA’s simplification efforts, certain pitfalls can still hinder a timely and accurate application. US families must be vigilant to avoid common mistakes that could delay financial aid processing or reduce eligibility. Awareness and careful preparation are the best defenses against these potential issues. Many errors stem from misunderstanding new rules or overlooking small but critical details, emphasizing the need for thorough review before submission.

One frequent issue is the failure to create or retrieve an FSA ID for all necessary parties—students and parents. Without a valid FSA ID, the application cannot be electronically signed and submitted. Another common problem arises from misinterpreting financial information or failing to utilize the IRS Direct Data Exchange (DDX) correctly. While the DDX is mandatory for most applicants, ensuring the correct tax year information is linked is vital. These seemingly minor errors can lead to requests for additional documentation, prolonging the aid process.

Strategies to Avoid FAFSA Errors

- Verify FSA IDs: Ensure both student and parent FSA IDs are created and accessible well before starting the application. If forgotten, retrieve them promptly.

- Utilize Direct Data Exchange (DDX): Consent to and successfully use the IRS DDX. This automatically imports tax data, reducing manual entry errors. Do not skip this step.

- Accurate Asset Reporting: Understand what assets need to be reported and which are excluded. For example, the value of the family’s primary residence is not reported.

- Review Carefully: Before submitting, thoroughly review every section of the FAFSA for accuracy and completeness. Double-check Social Security numbers, birth dates, and income figures.

By proactively addressing these common pitfalls, families can ensure a smoother application experience for the new FAFSA 2025-2026. A correctly submitted FAFSA is the foundation for a successful financial aid outcome, helping students access the support they need for their education.

Resources and Support for FAFSA Applicants

Navigating the complexities of the new FAFSA for 2025-2026 doesn’t have to be a solitary endeavor. A wealth of resources and support systems are available to assist US families every step of the way. Leveraging these tools can provide clarity, reduce anxiety, and help ensure a successful application. From government-sponsored websites to institutional aid offices and community organizations, help is readily accessible for those who seek it.

The Federal Student Aid (FSA) website remains the primary and most authoritative source of information. It offers detailed guides, FAQs, and direct contact options for assistance. Additionally, college financial aid offices are invaluable resources, as they can provide institution-specific guidance and help with unique circumstances. Many high schools also offer FAFSA workshops or counseling services for students and parents, particularly during peak application periods. These local resources can offer personalized support tailored to individual needs.

Where to Find Help and Information

- Federal Student Aid (FSA) Website: StudentAid.gov is the official hub for all FAFSA-related information, including detailed instructions, videos, and contact information for federal aid representatives.

- College Financial Aid Offices: Reach out to the financial aid departments of the colleges your student is applying to. They can offer specific advice on institutional aid, deadlines, and any unique requirements.

- High School Counselors: Many high school guidance counselors are well-versed in the FAFSA process and can provide assistance, host workshops, or direct families to local support services.

- FAFSA Help Line: The Federal Student Aid Information Center (FSAIC) offers phone support for FAFSA applicants. Their contact information is available on the StudentAid.gov website.

Utilizing these resources effectively can demystify the new FAFSA 2025-2026 application process. Proactive engagement with available support systems ensures families are well-informed and confident in their pursuit of federal student financial aid.

Key Change |

Impact for Families |

|---|---|

SAI Replaces EFC |

New index for aid eligibility; can be negative, showing greater need. |

Streamlined Form |

Fewer questions, easier completion, reducing application burden. |

IRS Direct Data Exchange |

Mandatory tax data transfer, minimizing errors and manual input. |

Expanded Pell Grants |

More students eligible for Pell Grants, linked to poverty levels. |

Frequently Asked Questions About the New FAFSA

The most significant change is the replacement of the Expected Family Contribution (EFC) with the Student Aid Index (SAI). The SAI is a new metric that can be a negative number, potentially increasing aid eligibility for students with greater financial need.

While the exact date is not yet announced, the 2025-2026 FAFSA is expected to open in late 2024. Families should monitor the official Federal Student Aid website (StudentAid.gov) for the most current information and specific launch dates.

Yes, the new FAFSA rules are designed to expand Pell Grant eligibility. More students, especially those from low-income backgrounds, will qualify for maximum Pell Grant awards based on their Student Aid Index and income relative to federal poverty levels.

Yes, if a student is dependent, at least one parent will still need an FSA ID to sign the FAFSA electronically. Both the student and a parent must have an FSA ID to complete and submit the application.

The new FAFSA removes the benefit for having multiple children in college from the aid calculation. This means your Student Aid Index (SAI) may be higher than your previous Expected Family Contribution (EFC), potentially affecting aid amounts.

What Happens Next

As US families prepare for the new FAFSA 2025-2026 cycle, the focus shifts to proactive engagement and continuous monitoring. The Department of Education will likely release further clarifications and resources as the application launch approaches. Families should prioritize creating FSA IDs, gathering necessary documentation, and staying informed about state and institutional deadlines. The long-term implications of these FAFSA reforms are expected to broaden access to higher education, but individual preparation remains key to maximizing financial aid opportunities in this evolving landscape.